This article will discuss how to account for a lease when the tenant expands the leased premises outside of the terms of the initial lease. In this scenario, the lessee decided to expand the leased property but had no obligation or right to do so in the original lease agreement.

When a lease is amended to expand the leased premises, the amendment may be considered a new lease agreement. Under ASC 840 and ASC 842 specific criteria exist for triggering a separate lease for accounting purposes. Additionally, once it is determined a separate lease exists, the accounting treatment for the new lease is specific to each standard.

Accounting for amendments resulting in additional assets under ASC 840

Under ASC 840, when a tenant expands an existing lease, a new straight-line rent expense schedule must be created. The following five items are aggregated in the new schedule and allocated over the new lease term on a straight-line basis:

- The remaining payments for the original lease

- The payments for the expanded premises

- The deferred rent balance for the original lease, immediately prior to the expansion

- The unamortized tenant improvement allowance (TIA) for the original lease, immediately prior to the expansion

- Any new TIA for the expanded premises.

The following example will illustrate the accounting under ASC 840 for a lease amendment resulting in the right to use an additional asset or assets.

Example: Accounting for amendments resulting in obtaining additional asset(s) under ASC 840

Assume XYZ, Inc. enters into a 10-year lease with a landlord for one floor of a building with the following terms:

- Payments: $15,000/month

- Escalation: 4%, annually

- Lease commencement: January 1, 2016

- Lease end date: December 31, 2025

- TIA: $80,000

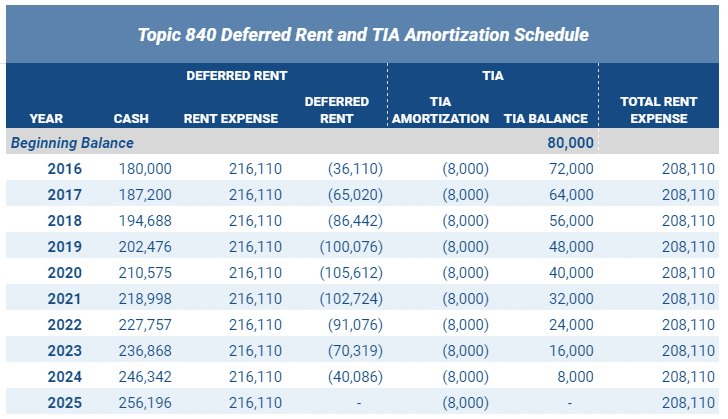

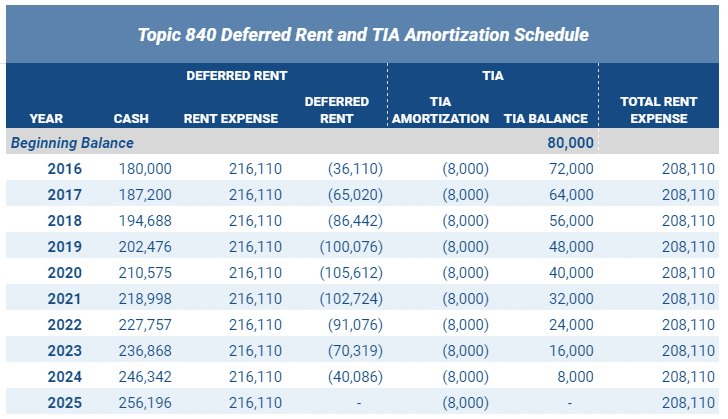

The monthly rent and the TIA of $80,000 are straight-lined over the 10-year lease term, resulting in total annual rent expense of $208,110. The full amortization schedule is as follows:

Now, assume on January 1, 2018, XYZ, Inc. signs an amendment to the original lease to rent an additional floor in the building due to growth, with payment terms of $14,000/month and annual rent increases of 4%. For the additional floor, the landlord provides XYZ, Inc. an additional $150,000 in TIA, paid in cash.

The payment terms for the lease of space under the original lease remain unchanged. XYZ, Inc. obtains access to the second floor on January 1, 2018, and the end date of the contract for the total leased premises remains unchanged on December 31, 2025.

Under ASC 840, when a lease is amended to expand the leased premises, the amendment is considered a new lease, and any deferred rent under the prior lease should be included in the calculation of straight-line rent expense for the new lease term.

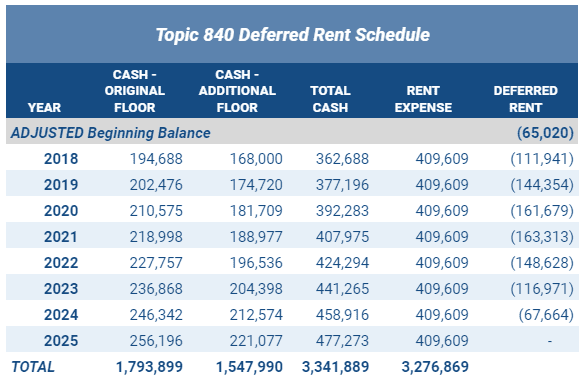

The remaining lease term at the date of the amendment is eight years due to the fact that the end date remained unchanged. Total rent expense excluding the TIAs is calculated as the sum of the total lease payments for both floors adjusted by the deferred rent balance from the initial lease divided by the lease term. The annual rent expense, excluding the adjustment for the TIA is therefore $409,609 ([$3,341,889 total payments – $65,020 prior deferred rent balance] / 8 years).

We outline these calculations in detail below.

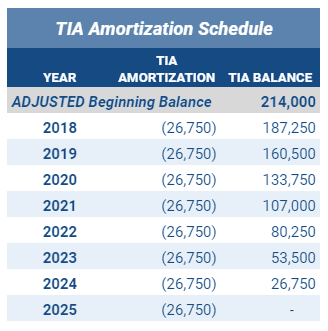

For simplicity, we are addressing the tenant improvement allowances separately from rent. The total TIA to amortize over the remaining original lease term is $214,000 calculated as the prior unamortized TIA balance ($64,000) plus the new TIA ($150,000) amount. The new TIA balance is now amortized over the remaining lease term of eight years, resulting in a schedule as follows:

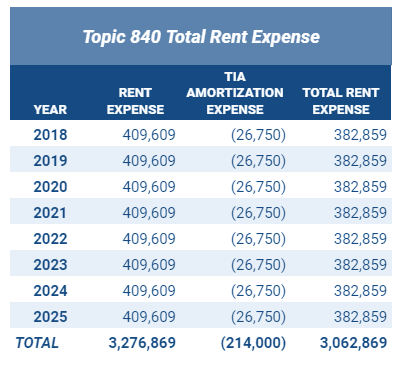

The combined schedule of annual rent expense consisting of the straight-lined lease payments less the amortization of the TIA is below:

Accounting for amendments resulting in additional assets under ASC 842

Under ASC 842, when a tenant expands an existing lease, certain criteria have to be met to treat the amendment as a new lease versus a modification of the existing lease. A lease amendment must do both of the following:

- Grant the lessee an additional right of use, not specified in the original contract

- Require lease payments for the additional right of use equivalent to the standalone price for the additional right of use, including adjustments for conditions unique to the contract

To explain further, the amendment must include an additional right of use asset with payment similar to what would be required for the same asset under a standalone contract. However, some amount of variance to the standalone pricing may be appropriate if supported by the circumstances of the contract.

The following example will illustrate the accounting according to ASC 842 for a lease amendment resulting in the right to use an additional asset or assets.

Example: Accounting for amendments resulting in obtaining additional asset under ASC 842

Similar to our previous example, assume XYZ, Inc. enters into a 10-year lease with a landlord for one floor of a building with the following terms:

- Payments: $15,000/month

- Escalation: 4%, annually

- Lease commencement: January 1, 2018

- Lease end date: December 31, 2027

- TIA: $80,000

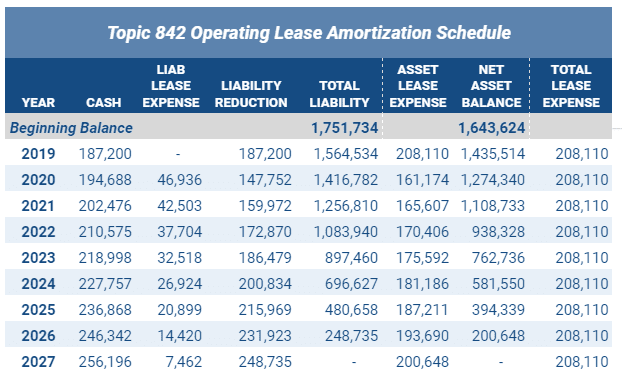

The rent for the first floor and the TIA of $80,000 are straight-lined over the 10-year lease term, resulting in total annual rent expense of $208,110. XYZ, Inc. is a public entity who plans to transition to ASC 842 on January 1, 2019. As a result, the lease amortization table below is identical to the one under the ASC 840 example, except for a January 1, 2018 commencement date.

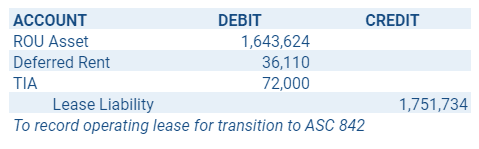

Now, assume XYZ, Inc. transitions to ASC 842 on January 1, 2019. The lease is classified as an operating lease and the incremental borrowing rate in effect at transition is 3%. To transition to ASC 842 the lessee calculates the lease liability as the present value of the remaining lease payments, which equals $1,751,734. The right of use (ROU) asset is the lease liability minus the unamortized incentive balance of $72,000 and the deferred rent of $36,110. The journal entry to record the lease at transition to ASC 842 is:

The full amortization schedule for the lease liability and ROU asset immediately following transition is below:

Note that transitioning to ASC 842 has no impact on the total straight-line lease expense recognized by the lessee each year.

Next, on January 1, 2021, due to a growing internet sales business, XYZ, Inc. signs an amendment to the original lease to rent an additional floor in their current building, with the following terms:

- Payments: $14,000/month

- Escalation: 4%, annually

- Lease amendment effective date: January 1, 2021

- TIA: $150,000

- Discount rate: 1.5% incremental borrowing rate

The payment terms for the lease of space under the original lease remain unchanged. XYZ, Inc. obtains access to the second floor and receives the TIA as a lump sum payment on January 1, 2021. The end date of the contract for the total leased premises remains unchanged at December 31, 2027.

To apply the correct accounting treatment under ASC 842, XYZ, Inc. must determine if the amendment meets the criteria for a new lease. In order for the amendment to be considered a new lease for accounting purposes, the amendment must grant XYZ, Inc. an additional right of use which was not part of the original contract and the payment terms must be equivalent to a standalone lease agreement.

The amendment in this example is for the use of an additional floor of space. The option to lease the additional floor was not mentioned in the original contract. Thus, the amendment is providing XYZ, Inc. with an additional right of use and the first criteria for a new lease is met.

The second criteria is for the payment terms to be commensurate with a standalone lease agreement for a similar asset. In this scenario, the original lease for office space was for $15,000/month. The original lease was for a single floor and represents a standalone lease. The amendment offers the additional floor at a rate of $14,000/month. The reduction is not a significant departure from the payment terms of the original lease and may represent a portion of the benefit gained by the landlord for not having to locate a new tenant.

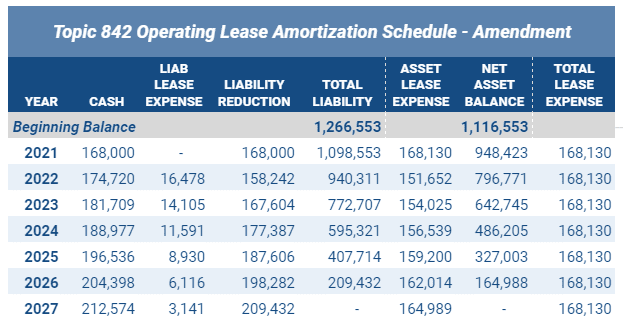

As a result of the amendment meeting both criteria for a new lease agreement, the original amortization table and accounting for the lease of the first floor will not change. Instead, XYZ, Inc. will treat the amendment as a new, standalone lease agreement. Assuming in this scenario the lease amendment also qualifies as an operating lease, XYZ, Inc. must now calculate the lease liability and ROU asset for the new lease.

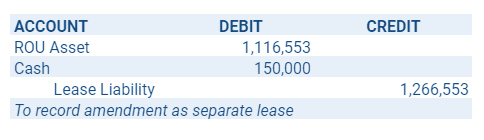

The lease liability for the amendment is the present value of the payments over the remaining seven years of the lease term at the discount rate of 1.5%, calculated to be $1,266,553. The ROU asset is equal to the lease liability less the TIA received at lease commencement, or $1,116,553 ($1,266,553 – $150,000). The entry to record the lease amendment as a separate lease is:

The amortization schedule for the amendment as a separate lease under ASC 842 is below:

Summary

A lease amendment that increases the lessee’s original rights may be considered a new lease. Under ASC 840 and ASC 842 specific criteria exist for triggering a separate lease for accounting purposes. Additionally, once it is determined a separate lease exists, the accounting treatment for the new lease is specific to each standard. This accounting treatment also applies if the tenant expands their lease with an amendment for more space in a completely different building, as long as it is leased from the same landlord.